How Much Will Bitcoin Cost In 2030: Predictions and Analysis

How Much Will Bitcoin Cost In 2030: Predictions and Analysis

As the world of cryptocurrency continues to evolve and gain mainstream acceptance, the question on many investors’ minds is: How Much Will Bitcoin Cost In 2030? With Bitcoin’s price volatility and market trends constantly shifting, it can be challenging to predict the future value of this digital asset. In this analysis, we will delve into various factors that could influence Bitcoin’s price in 2030 and explore different predictions from experts in the field. Join us as we take a closer look at the potential future trajectory of Bitcoin and what it could mean for investors and enthusiasts alike.

In 2030, several factors are likely to influence the price of Bitcoin. One key factor is the continued adoption of Bitcoin as a mainstream form of payment and investment. As more businesses accept Bitcoin as a legitimate payment method and more individuals see it as a store of value, the demand for Bitcoin is expected to increase, potentially driving up its price.

Additionally, regulatory developments will play a crucial role in shaping Bitcoin’s price in 2030. Clear regulations that provide legal clarity for the use and trading of cryptocurrencies can boost investor confidence and encourage more institutional adoption, leading to a positive impact on Bitcoin’s price.

Moreover, advancements in technology, such as scalability solutions, improved security measures, and increased efficiency in transactions, can also contribute to the growth of Bitcoin’s price in 2030. These technological developments can enhance the usability and accessibility of Bitcoin, attracting more users and investors to the market.

By considering these factors, it is possible to envisage a scenario where Bitcoin’s price in 2030 reflects a combination of increased adoption, regulatory support, and technological progress, potentially leading to significant value appreciation.

Potential regulation can have a significant impact on the value of Bitcoin in 2030. As governments around the world continue to explore ways to regulate cryptocurrencies, any new regulations could affect the supply and demand dynamics of Bitcoin. If regulations are favorable and provide more legitimacy to Bitcoin, it could lead to increased adoption and investment, driving up its value. On the other hand, if regulations are restrictive or negative, it could dampen investor confidence and hinder Bitcoin’s growth potential.

In simple terms, regulation can either boost or hinder Bitcoin’s value in 2030. If governments create a supportive regulatory environment, it could pave the way for more widespread acceptance and usage of Bitcoin, ultimately driving up its value. Conversely, if regulations are stringent or negative, it could restrict Bitcoin’s growth and limit its potential value in the future. As such, keeping an eye on regulatory developments will be crucial for predicting Bitcoin’s performance in 2030.

Various experts have made bold predictions about the future price of Bitcoin in 2030. Some believe that Bitcoin could reach astronomical heights, with price targets ranging from $500,000 to $1 million per coin. These optimistic forecasts are based on factors such as increasing adoption, limited supply, and growing institutional interest in cryptocurrencies.

On the other hand, more conservative estimates suggest that Bitcoin’s price in 2030 could be closer to $100,000 or even lower. These predictions take into account potential regulatory challenges, market volatility, and the emergence of competing digital assets. While it’s difficult to predict the exact price of Bitcoin in 2030, it’s clear that the cryptocurrency market is poised for continued growth and evolution in the coming years.

In summary, experts’ predictions for Bitcoin’s price in 2030 vary widely, ranging from $100,000 to $1 million per coin. Factors such as adoption rates, regulatory developments, and market dynamics will all play a role in determining the future value of Bitcoin. As the cryptocurrency landscape continues to evolve, investors should carefully consider these factors when making decisions about their digital asset portfolios.

By 2030, Bitcoin’s price could be influenced by various technological advancements that may impact its adoption and value. One key factor to consider is the development of scalable solutions for Bitcoin, such as the implementation of the Lightning Network or other layer 2 solutions. These technologies aim to improve the speed and efficiency of Bitcoin transactions, potentially increasing its usability and attractiveness to a wider audience.

Additionally, advancements in blockchain technology, such as the integration of smart contracts or privacy features, could also play a significant role in shaping Bitcoin’s price by 2030. Smart contracts could enable more complex transactions to be conducted on the Bitcoin network, while enhanced privacy features could appeal to users seeking greater anonymity and security.

Overall, technological advancements that enhance the functionality, scalability, and privacy of Bitcoin have the potential to drive increased adoption and demand for the cryptocurrency, ultimately influencing its price in the years to come.

Global economic trends can have a significant impact on the value of Bitcoin in 2030. One key trend to consider is the increasing adoption of digital currencies by governments and businesses. As more countries explore the possibility of creating their own digital currencies or integrating blockchain technology into their financial systems, Bitcoin could benefit from increased legitimacy and acceptance.

Another important trend to watch is the ongoing shift towards a cashless society. With more transactions being conducted electronically and mobile payments becoming the norm, Bitcoin could see a surge in demand as a decentralized digital currency that offers privacy and security to users.

Additionally, the overall economic climate, including factors such as inflation rates, interest rates, and geopolitical events, will also play a role in determining the value of Bitcoin in 2030. Investors should closely monitor these trends to make informed decisions about their Bitcoin holdings.

Market sentiment and investor behavior play a crucial role in determining the future price of Bitcoin. The way people feel about Bitcoin, whether positive or negative, can significantly impact its value. If investors believe that Bitcoin will continue to grow and gain mainstream acceptance, they are more likely to buy and hold onto their Bitcoin, driving up the price. On the other hand, if sentiment turns negative, investors may start selling their Bitcoin, causing prices to drop.

In recent years, we have seen a growing acceptance of Bitcoin as a legitimate asset class, with institutional investors and major corporations starting to invest in and accept Bitcoin. This positive sentiment has fueled a surge in prices, with many experts predicting that Bitcoin could reach new heights in the coming years. However, it’s important to note that market sentiment can be fickle, and factors such as regulatory changes or market volatility can quickly change investor behavior and impact Bitcoin’s price.

Overall, keeping an eye on market sentiment and investor behavior can provide valuable insights into where Bitcoin’s price may be headed in the future. By staying informed and understanding the factors that drive investor sentiment, you can make more informed decisions when it comes to investing in Bitcoin.

Environmental concerns are a critical factor that could impact Bitcoin’s price projection for 2030. The growing focus on environmental sustainability has led to increased scrutiny of the energy-intensive nature of Bitcoin mining. As concerns about carbon emissions and climate change continue to rise, the environmental footprint of Bitcoin mining is under scrutiny.

The potential for regulatory measures to address environmental concerns related to Bitcoin mining could impact its price projection for 2030. If governments impose strict regulations on the use of energy for cryptocurrency mining, it could increase costs for miners and potentially reduce the profitability of Bitcoin mining operations. This, in turn, could have a downward pressure on Bitcoin’s price projection for 2030. It is essential for the cryptocurrency industry to address these environmental concerns proactively to ensure its long-term sustainability and growth.

In 2030, Bitcoin’s market position may face significant challenges from emerging competition in the form of other cryptocurrencies. As new digital assets continue to enter the market, they could potentially erode Bitcoin’s dominance and market share. These competitors may offer different features, technological advancements, or use cases that could attract investors and users away from Bitcoin.

To maintain its position as the leading cryptocurrency in 2030, Bitcoin will need to adapt and innovate to stay ahead of the competition. This could involve implementing upgrades to improve scalability, transaction speed, and security. Additionally, fostering partnerships with industry leaders and promoting widespread adoption will be crucial for Bitcoin to solidify its market position in the face of increasing competition. By staying responsive to evolving market dynamics and continuously enhancing its value proposition, Bitcoin can continue to thrive in the fast-paced world of digital currencies.

Geopolitical events can have a significant impact on the value of Bitcoin by 2030. Factors such as trade wars, economic sanctions, and political instability in major countries can create both positive and negative effects on the cryptocurrency market. For example, if a country experiences hyperinflation or currency devaluation due to geopolitical tensions, investors may turn to Bitcoin as a safe-haven asset, increasing its value. On the other hand, regulatory crackdowns or bans on cryptocurrency in certain regions could lead to a decrease in demand and a drop in Bitcoin’s price.

Moreover, geopolitical events can also influence the adoption and acceptance of Bitcoin as a mainstream form of payment. If major economies start embracing digital currencies or if global financial systems face disruptions, Bitcoin could see a surge in popularity and value. However, increased government scrutiny or restrictions on cryptocurrency usage could hinder its growth and potential price appreciation. Overall, staying informed about geopolitical developments and their potential repercussions on Bitcoin is essential for investors looking to understand the future value of the digital asset by 2030.

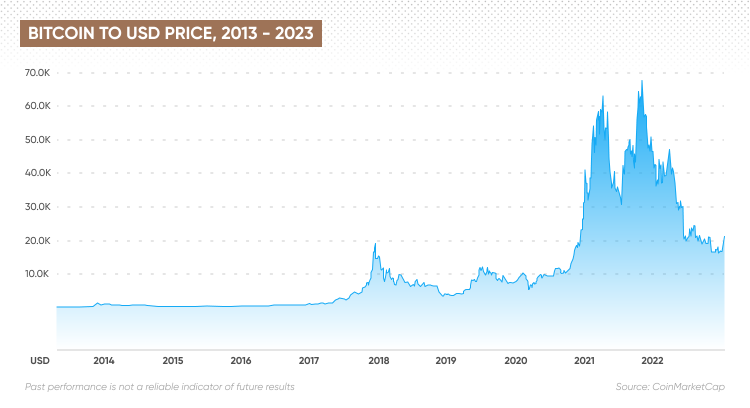

Analyzing historical data is crucial when predicting Bitcoin’s potential cost in 2030. By looking at past trends, we can gain valuable insights into how the cryptocurrency has performed over time and what factors have influenced its price. For instance, Bitcoin’s price has experienced significant fluctuations in the past, reaching all-time highs and lows based on market demand, regulatory changes, and investor sentiment.

Based on historical data analysis, many experts believe that Bitcoin’s price will continue to rise in the coming years. Some predictions suggest that by 2030, Bitcoin could potentially reach a value of [insert predicted value], driven by increased adoption, institutional investment, and growing acceptance as a legitimate asset class. However, it’s important to note that the cryptocurrency market is highly volatile, and unforeseen events could impact Bitcoin’s price trajectory in the future. Therefore, investors should approach any predictions with caution and conduct thorough research before making investment decisions.